Technical analysis provides a structured approach to studying financial market behavior, offering what can feel like a map of the market’s terrain. However, as any investor knows, the map is not the territory. Markets evolve, news breaks, and unforeseen events can muddy even the clearest patterns.

While technical analysis is one of the most widely used and proven approaches for identifying and evaluating investment opportunities, common errors can lead even experienced investors to mistake the map for the territory. After decades of providing financial research resources and tools to investors, we are able to share the top technical analysis mistakes you should avoid.

1. Overlooking the Importance of Aligning Time and Price

Failing to align time-based trends with price patterns can lead to missed opportunities. Studying longer-term cyclical behavior can help identify timing considerations when researching price patterns and trends. This can be a key benefit in helping pinpoint potential entry and exit points, generally speaking. This is not about trying to time a market perfectly. No one can consistently time a market perfectly. But studying cyclical timing behavior can be a consideration in your decision-making process.

This is where the Socrates Platform Timing Arrays and our price-based Reversal System can be useful tools for your analysis, among other data points. Aligning your timing considerations with price behavior, including levels of technical support, technical resistance, and breakouts offers a balanced view of market behavior. Without this unique alignment of time and price in your research, investors and traders may act against the broader market flow or miss critical signals.

2. Neglecting Market Conditions

Technical analysis relies on historical price and volume patterns, but it's important to be observant of external factors that can impact market behavior, such as economic data releases, geopolitical events, central bank decisions, and even weather patterns and natural disasters. Ignoring these events can lead to unpleasant surprises, as long-term trends and technical patterns may break down in the short term based on response to sudden news or economic shifts. This is where you can experience false moves and corrections that won't change the long-term trend, but can flush out investors and traders in the relative near-term.

Factor in the Big Picture

Market conditions don’t exist in isolation. It's important to keep in mind the interconnectedness of global financial markets. What happens in Europe or Japan may affect US markets, and vice versa. Global economic, geopolitical, health and/or weather events can also impact the markets, such as confidence and commodity prices. Be mindful of activity across asset classes and capital shifts between public (government bonds) and private (stocks) sectors. This is why the Socrates Platform includes covered markets from around the world, enabling users to study the big picture.

3. Not Using the Right Indicators for the Right Job

A common pitfall in technical analysis is mismatching indicators with their intended purpose, leading to misinterpreted signals and murky insights. Common issues include:

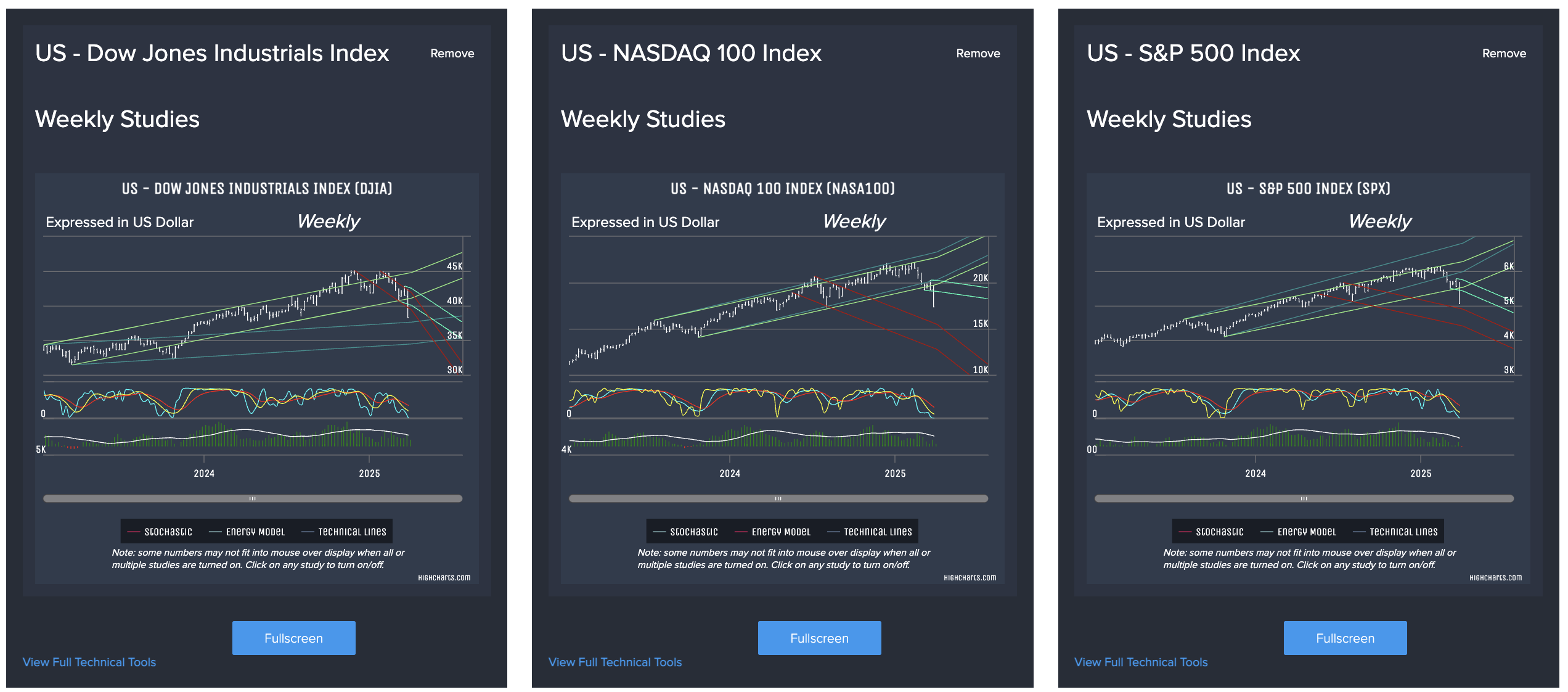

- Overreliance on a Few Indicators: Some investors and traders lean too heavily on popular indicators like stochastics or moving averages, while others may focus specifically on trend lines and pivot points. While valuable, no single indicator or viewpoint can capture all market dynamics.

- Overfitting Charts: Adding too many indicators to a chart can lead to “paralysis by analysis,” where unnecessary complexity frustrates decision-making. Identify the studies that work for you, focus on them primarily, and then bring in others to challenge your ideas. This is often more productive than studying all indicators at once.

- Misusing Indicators: Applying indicators for purposes they aren’t designed for, or using them inconsistently, can distort your analysis. For instance, using momentum indicators in a range-bound market may lead to misleading entries and exits.

Choose Indicators with Purpose

Choose indicators that align with your strategy. Use complementary pairs — like combining stochastics and our proprietary Energy Model with trend lines and volume analysis for confirmation — to avoid information overload and maintain a clear view. Streamlined, targeted charts are key to actionable insights.

How to Use Technical Analysis to Make Smarter Financial Decisions

In this guide, we explore how an understanding of technical analysis can help you perform your own market research, better navigate volatility, and become a more confident and data-driven investor.

4. Investors Focusing Only on Short-Term Gains Instead of Long-Term Goals

This captures the primary difference between trading and investing. Traders tend to make short-term market entries and exits, requiring a disciplined approach and risk appetite that isn’t for everyone. Traders often engage in high-frequency trading that overlooks or can run counter to broader market trends. Trading is a high-risk activity, and the lure of quick profits can tempt traders to abandon their thesis and fall victim to short-term movements.

Investors on the other hand study financial markets in pursuit of long-term opportunities to capitalize on market moves over a long-term period, regardless of short-term noise and volatility.

Align with Long-Term Goals

Set both short- and long-term goals to keep your focus steady. Consider how you’ll navigate changing market phases, like adjusting your strategy when a bullish market turns bearish. A balanced view of market dynamics reduces impulsive reactions and aligns decisions with your overall goals, whether you are trading or investing.

5. Emotional Biases and Self-Confirmation

Emotions cloud judgment, causing investors to misinterpret technical signals in ways that align with their hopes or fears. For instance, confirmation bias can lead traders to see only what they want to see, reinforcing pre-existing beliefs about market direction. This is very common and can result in holding onto losing positions too long or cutting winners short.

Overcome Bias for Clearer Decision-making

Recognize that human bias affects every decision, and commit to objective analysis rooted in historical data. Regular self-reflection, combined with a willingness to challenge assumptions, keeps your approach grounded and reduces the influence of personal biases.

This is the premise behind the Socrates Platform — to offer an unbiased, data-driven tool to research global financial market behavior.

Towards Precise and Confident Technical Analysis

Technical analysis provides an invaluable map to understanding financial market patterns and trends. But remember: it’s only a guide, not a guarantee. By sidestepping these common pitfalls, you’ll be better equipped to try and navigate the market’s evolving landscape with confidence.

The Socrates Platform offers tools that align with this disciplined approach, providing robust indicators, long-term trend insights, and objective, data-driven analysis. Our platform offers tiers catering to investors of all levels, making it an ideal research platform regardless of your research needs.