Proprietary Models

The Energy Model

Measuring Momentum in Financial Markets

The Energy Model assesses the cumulative rate of change in a market's price movement as a measure of the relative strength or weakness - or "energy" - is behind the current "bullish" (long) side of a market's price activity vs. the "bearish" (short) side.

A simple way to think of it, the Energy Model is a measurement of momentum, which can slow down when a market meets levels of resistance. The price activity in each market is a reflection of current push-and-pull forces behind it.

When the force behind the "bulls" on long side of a market loses energy, the momentum slows down, giving way to the "bears" on the short side.

The Energy Model is an innovative tool that gauges the relative strength or weakness of the bullish (long-side) market price activity, with its ability to enhance the assessment of over-bought and over-sold conditions. The energy Model is a tool for perceiving market momentum.

By quantifying the energy behind market movements, it provides a deeper understanding of momentum dynamics. This unique perspective on bullish and bearish forces offers insights into trend reversals, shifts in sentiment, and potential over-extended conditions.

While the Energy Model opens new doors for understanding market momentum, it's important to note that the Energy Model, just like any other indicator, offers only one view of a market and should be part of a more comprehensive analysis toolkit when you are researching financial markets.

Importance of Momentum Indicators

The Energy Model

Measuring the "energy" (or momentum) behind the buyers (bulls) in a financial market versus the sellers (bears) is a time-tested approach to researching financial market trends. Similar to stochastic studies, the Energy Model can serve as a helpful indicator of when a market may enter over-bought or over-sold conditions.

Understanding the Energy Model

The market is a never-ending battleground between bulls and bears - a constant tug-of-war shaping price movements. The Energy Model attempts to interpret this. As the bullish side loses its energy, the momentum can weaken and succumb to the pull of the short side. This can serve as a valuable indicator of possible trend reversals and shifts in market sentiment.

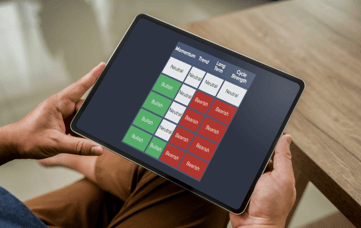

The Energy Model in Action

The best way to use this tool is alongside a price chart and other technical indicators - including traditional stochastic oscillators. As you study the Energy Model it can be a helpful consideration point when analyzing a market's trend and possible areas of price resistance and support. The more comprehensive your research is, the more informed your decision-making can be.

Other Proprietary Models

View Our Membership Plans

The Socrates Platform is designed to give anyone direct access to information that was originally intended for industry professionals. This easy-to-use software-as-a-service solution allows you to research what you want, when you want. With different levels of engagement, the Socrates Platform has a version that works for just about anybody.

.png?upsize=true&upscale=true&width=361&height=228&name=Economic%20Confidence%20Model%20(Final).png)