Proprietary Models

Global Market Watch (GMW)

Finding Patterns in Global Financial Markets

The Global Market Watch (GMW) is a proprietary pattern recognition model purpose-built with machine learning algorithms that analyze global economic and financial market data.

Studying financial markets to identify underlying patterns in price activity is common, but not simple. While patterns can present themselves within an existing upward or downward trend, they can also signify a new trend has formed.

As the GMW records new data from each Covered Market (financial instrument) listed in the Socrates Platform, it benchmarks each of them independently against a unique database with thousands of historical patterns it has cataloged over the years to consider significance and whether any patterns may be reoccurring vs newly forming.

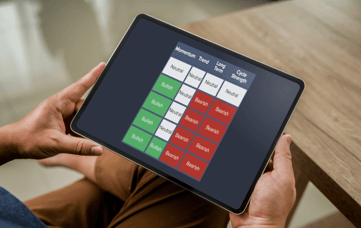

The front-end output is formatted in a simple color and comment design.

The colors and comments are generated by the model based on the activity it is picking up on as each week, month, quarter and year progresses.

The more history and data processed, the more the Global Market Watch model is learning. Each day it produces color and comments for each Covered Market from a daily, weekly, monthly, quarterly and yearly point of view.

The Global Market Watch is a pattern recognition tool offering a birds-eye view of financial market performance from around the world so users can easily monitor and identify areas they may want to research further.

Financial Market Pattern Recognition

The Future of Financial Analysis

As financial markets continue to evolve, the need for sophisticated - yet easy to use - tools to process and interpret vast amounts of data becomes increasingly important. The Global Market Watch bridges the gap by providing users with a powerful yet easily understandable view of global financial market pattern behavior from a daily, weekly, monthly, quarterly and yearly perspective.

Ease and Speed of Analysis

One of the key advantages of Global Market Watch is its ease of use and quick reference format. The model systematically assigns different colors, text phrases and font treatment to signify what potential patterns it is identifying. Examples of computer-generated phrases include "entering breakout" or "knee-jerk reaction" or "phase transition" among others. At a glance, this user-friendly interface provides visual and contextual cues on potential patterns the models are recognizing.

The Power of Machine Learning

At the core of the Global Market Watch's effectiveness lies its purpose-built machine learning algorithms and ability to process vast amounts of financial data on a global scale. This helps recognize complex patterns that may otherwise remain hidden for each financial instrument (Covered Market) in the Socrates Platform. And it does this across each time level (e.g. daily, weekly, monthly, etc), which translates into thousands of different points of output from the GMW alone after each market day.

Other Proprietary Models

View Our Membership Plans

The Socrates Platform is designed to give anyone direct access to information that was originally intended for industry professionals. This easy-to-use software-as-a-service solution allows you to research what you want, when you want. With different levels of engagement, the Socrates Platform has a version that works for just about anybody.

.png?upsize=true&upscale=true&width=361&height=228&name=The%20Reversal%20System%20707%20x%20448%20(1).png)