Proprietary Models

The Reversal System

Finding Pressure Points in Global Financial Markets

If studied over a long period of time, one can observe that financial markets have a motion and behavior demonstrated thru price movement within their own space and time. This price movement is driven by energy and pressure.

Available to Pro and Enterprise users, the Socrates Platform Reversal System is a proprietary technical analysis tool built with the principles of physics to help identify pressure points in price movement of global financial markets.

These pressure points (aka Reversal Points) can serve as areas of technical support and technical resistance. But more importantly, when a market closes above or below certain Reversal Points where enough pressure has built up, it can signal a possible turning point.

In the fast-paced world of financial markets, staying ahead of short-term price movement and long-term trends is a constant challenge. Traders and investors are always looking for an edge to cut through the "noise" of what is driving a market up or down. The Reversal System is a powerful, data-driven computer model designed to ignore the noise, assess market activity, and find pressure points in financial market price movement.

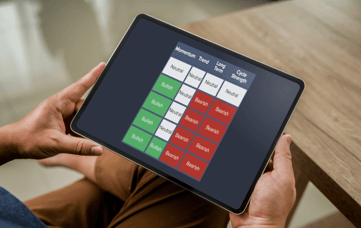

The Reversal System can be a valuable complement to traditional technical analysis studies. Reversal Points help shed light on areas of possible technical support (bearish reversals) and technical resistance (bullish reversals) that exist in a market's price activity. While Reversal points don't require drawing technical lines on a chart, they can be complementary. Reversals are generated across multiple time levels (daily, weekly, monthly, etc), offering unique perspective on trend.

While Reversal Points can be a valuable complement to traditional technical analysis studies, the true power of the Reversal System is the ability to research price levels where market change - turning points - may occur. Analyzing Reversals over time can help identify where price pressure may built up and, if breached on a closing basis, could then signal a shift (a "reversal") in short-term price direction, or even a possible change in the long-term trend.

Technical Analysis of Financial Market Trends

Value of Reversals

When utilized as part of a comprehensive research strategy, Reversal points can offer investors and traders a competitive edge when trying to anticipate potential shifts in price direction (reaction highs/lows, etc) or a change in longer-term trend of global financial markets.

The Reversal System is a key proprietary model accessed exclusively through our premium market tools.

Elected Reversals and Time Levels

When a market closes above a Bullish Reversal it is considered an Elected Bullish Reversal, which in some cases may indicate a potential shift from a downward trend to an uptrend.

If a market closes below a Bearish Reversal it is considered a Elected Bearish Reversal, which in some cases may indicate a potential shift from a uptrend to downtrend.

Reversals are generated for each time level (Daily, Weekly, Monthly, etc) and can only be elected on a close in the same time level. This makes it easier for users to study the Reversal System. Most Socrates Pro users focus on Monthly Reversals as it helps minimize the noise in day-to-day market movement, and is where trend changes are more likely to reveal themselves. Socrates Enterprise users also have access to Quarterly and Yearly Reversals.

Savvy and experienced users may study Reversals across time levels to see if there are similar price levels where pressure may be building.

Adding Reversal Points into technical analysis studies

Investors and traders can consider Bullish Reversals and Bearish Reversals as unbiased, computer-generated levels of technical resistance and technical support, respectively, when conducting traditional technical analysis. Overlaying technical lines and Reversal Points on a chart can be a helpful way to align trend, channel and price points of interest. Reversal Points can also be considered when determining price levels for stop-loss orders, stop-limit orders, or limit orders. The Reversal System can help add another layer of depth to the study of market price activity when developing market entry and exit strategies.

Other Proprietary Models

View Our Membership Plans

The Socrates Platform is designed to give anyone direct access to information that was originally intended for industry professionals. This easy-to-use software-as-a-service solution allows you to research what you want, when you want. With different levels of engagement, the Socrates Platform has a version that works for just about anybody.