Case Study

Uncovering Opportunity in British Pound Futures

Using Socrates to Research Short-Term Trading Strategies

The Socrates Platform is designed for a broad audience with varying levels of knowledge and expertise. For most users, Socrates is a tool to help research global market activity and long-term investment opportunities. But for advanced users experienced in active trading, Socrates can also be used to help identify short-term opportunities.

In this case study, we'll focus on an example of a short-term trade scenario where research on Socrates was used to help identify an opportunity in the British Pound Futures.

Keep in mind that short-term trading can accelerate or amplify the risk and magnitude of financial loss. It is not recommended for novice users or passive investors.

Market Scenario: Using Socrates to Analyze British Pound Futures

In July 2023, the GBP/USD pair experienced a relatively significant high, but if you weren't paying attention you would have missed a market opportunity.

For short-term traders, such market highs inspire questions: Will the upward trend continue? Is now the best time to enter or exit the market? How will market dynamics evolve in the near term?

In this situation, being aware of the market patterns and trends leading into the high are key to determining an investment or trading strategy.

Enter the Socrates Platform, which has various independent, proprietary computer models to aid in your research.

Performing an Initial Analysis Using Timing Arrays

The Timing Arrays in Socrates are tailored to analyze and aggregate cyclical activity in global financial markets across different time levels. In this scenario, the Arrays for the British Pound Futures were showing an alignment of cyclical models across daily, weekly, and monthly time levels, hinting at the potential for a turning point in the market in July 2023.

Note

For the Socrates models, the Monthly view is the most important — it is less susceptible to change based on short-term noise and false moves.

As you can see, the Monthly Timing Arrays indicated a potential turning point for July 2023, with strong signals for the Aggregate, Empirical, Volatility, and Long Term cycles.

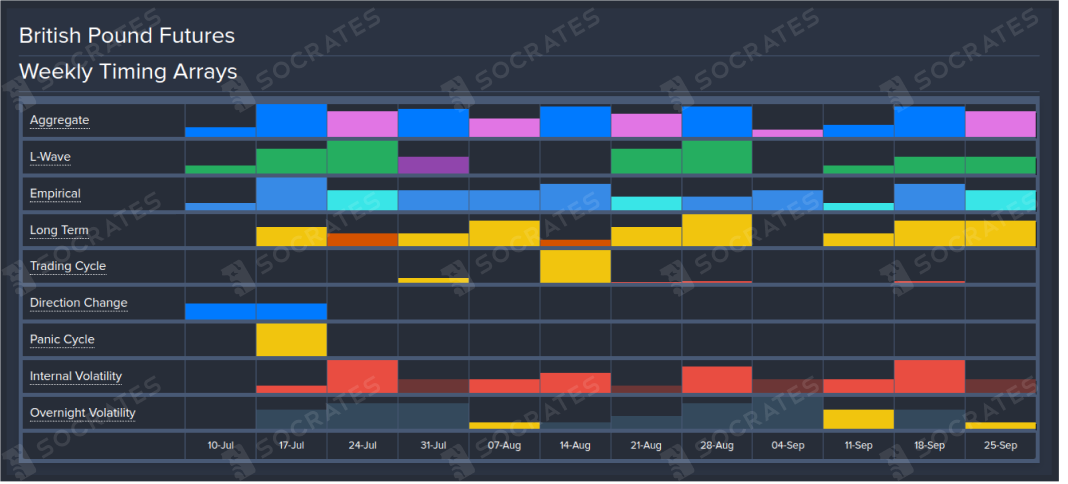

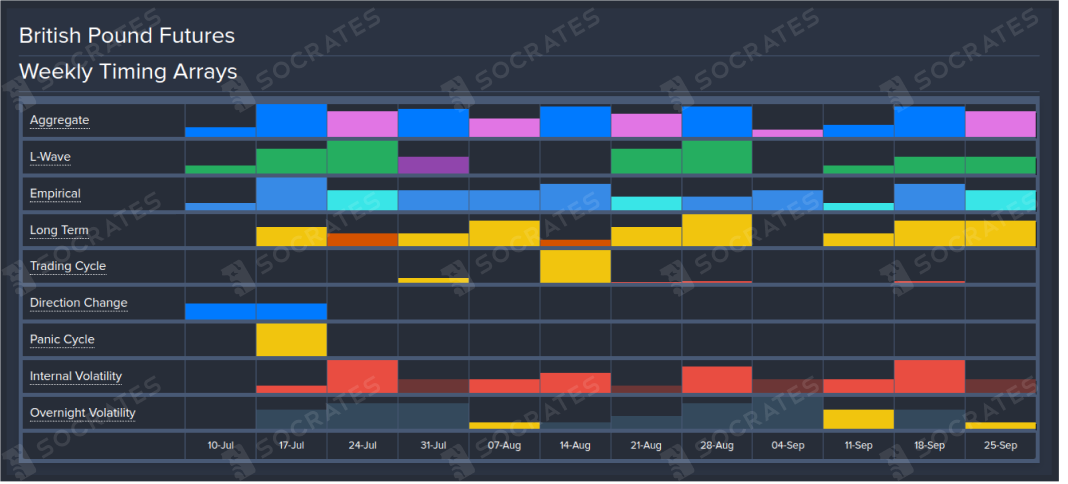

The Weekly Timing Array supported the Monthly view. The week of July 17th demonstrated the highest Aggregate bar, with future choppiness suggesting a possible volatile period ahead. The Empirical model further suggested a market reaction and directional change.

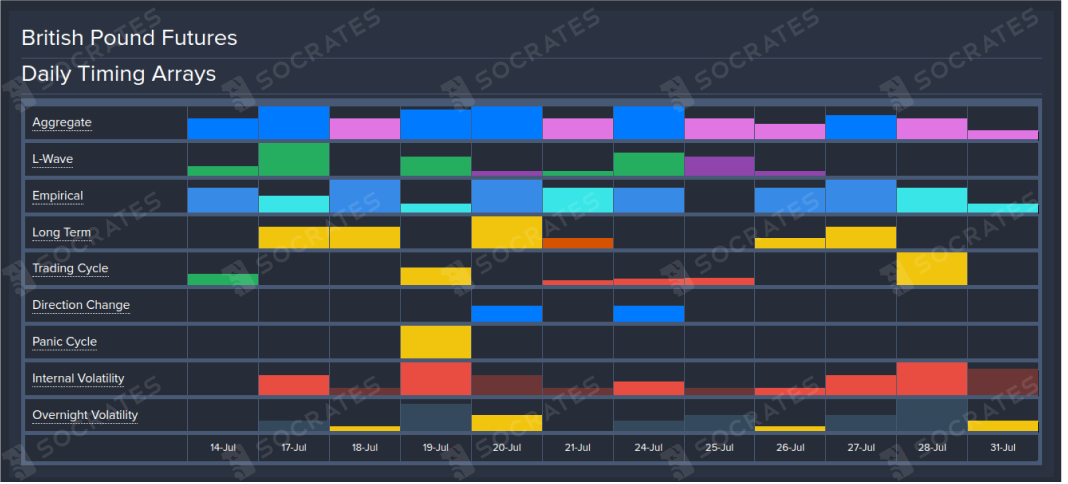

Zooming in with the Daily array, July 17th signified the largest Aggregate bar, with July 19th showing a Panic Cycle model reading, and July 20th showing a reading on the Direction Change model.

Note

The Daily time level in the Socrates models is the most susceptible to short-term noise and false moves in a market. One should never solely rely on or heavily weigh the Daily level. It is for advanced users to consider as a supplementary data point in their research.

As you can see, the Monthly Timing Arrays indicated a potential turning point for 23 July 2023, with strong signals for the Aggregate, Empirical, Volatility, and Long Term cycles.

The Weekly Timing Array supported the Monthly view. The week of July 17th demonstrated the highest Aggregate bar, with future choppiness suggesting a possible volatile period ahead. The Empirical model further suggested a market reaction and directional change.

Zooming in with the Daily array, July 17th signified the largest Aggregate bar, with July 19th showing a Panic Cycle model reading, and July 20th showing a reading on the Direction Change model.

Note

The Daily time level in the Socrates models is the most susceptible to short-term noise and false moves in a market. One should never solely rely on or heavily weigh the Daily level. It is for advanced users to consider as a supplementary data point in their research.

Results

By using the Timing Arrays to research the market’s cyclical activity, we were able to identify the week of July 17th as a potential turning point — and a few days within that week where cyclical activity seemed to be most notable.

After this analysis, we turned our attention to studying the price action of the underlying market.

Assessing Price Considerations using the Reversal System

The Reversal System in Socrates helps users identify potential pressure points in price movement. For those familiar with technical analysis, think of the Reversal System as a tool that helps highlight price points for a market to be mindful of and consider in your research. These price points are also known as Reversal points — or more simply as Reversals.

Reversals can represent areas of technical support and resistance. There are two types of Reversals: bullish and bearish. When a group of Reversals are clustered together, it suggests a stronger level of support (bearish Reversals) or resistance (bullish Reversals). When this clustering of Reversals occurs, more energy (momentum) will be needed to break through.

Note

The Reversal System is founded on the belief that pressure builds as price moves over time and there is a point at which, when breached, that pressure is released - signaling a potential change in direction is ahead. Sometimes this change can be a short-term correction, but it can also reveal a change in the long-term trend, especially when researching the Monthly time level.

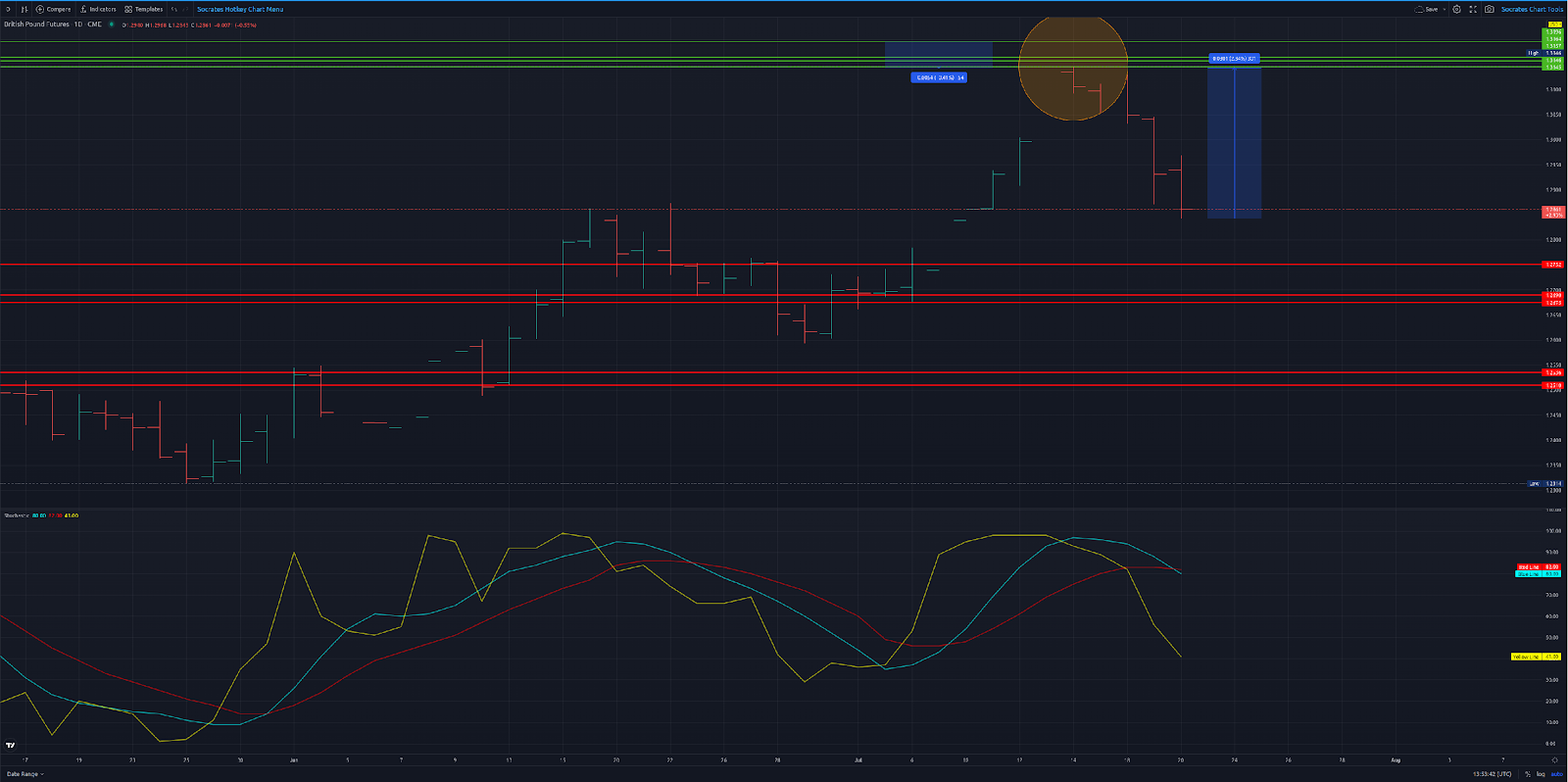

As you can see below, the price chart for the British Pound Futures revealed a relatively large group of bullish Reversals at the top. In fact, there are five bullish Reversals within 0.5% of each other. This indicates a relatively strong level of resistance that required a lot of energy (momentum) to break through.

On July 16, the market failed to break the first bullish Reversal.

On July 17th, the market also failed to break through, causing a decline in the market.

The chart also revealed a fairly large gap that existed between the group of bullish Reversals and the Bearish Reversals that were more spaced out. This gap in Reversals indicated relatively little support to stop a possible move to the downside.

When looking at price activity, we can also study the stochastics, which gauges market momentum. From this perspective, we were able to see that the British Pound Futures appeared to be overbought.

When a Stochastic value is 80 or greater, it is generally considered a signal that a market is overbought. In this example, you can see the Stochastic lines at the bottom of the chart turning back down. This activity further aligns with the earlier analysis of the bullish and bearish Reversals.

Reviewing Patterns from the Global Market Watch

Another tool found in Socrates is the Global Market Watch (GMW). This is a pattern recognition model that offers a broader perspective on market behavior across different time levels.

In this scenario, the GMW suggested a short-term high for the British Pound Futures when looking at the daily level around the time of the move. However, under further analysis, the model identified patterns that suggested the market was currently maintaining a bullish outlook across the longer intervals — including Weekly and Monthly time levels. This aligned with the earlier research, which ultimately culminated with the aforementioned high in the British Pound Futures, in July 2023.

From Research to Action

To recap, we used the Timing Arrays to identify when cyclical activity revealed possible turning points for a trade. By exploring the different time levels, we were able to identify the week of July 17th as a likely turning point. Once we developed an idea of the timing considerations, we moved on to price analysis.

Using the Reversal System, we identified an area of relatively high price resistance, a failure to break through bullish Reversals, and little support below — all suggesting a potential uninterrupted downward move.

Finally, the GMW provided another perspective. The daily level showed that a temporary high had potentially formed, but bullish patterns remained present for the longer term.

Collectively, this research indicated there was potential for a short-term reactionary decline approaching in July 2023.

Researching the various models in Socrates can open the door for investors and traders to strategize — whether they buy or sell to capitalize on or defend against an anticipated market movement. Or to take no action at all. Either way, researching within Socrates can help you make more informed market decisions.

IMPORTANT

Socrates is not a financial service, we do not provide financial advice or recommendations. The platform serves as a research tool for informational and educational purposes only.

Is Socrates right for you?

Explore our Membership Plans to find a version of Socrates that works for you. Or check out our guide on Socrates vs. Competitors.