Proprietary Models

Timing Arrays

Monitoring Cycles in Global Financial Markets

Put simply, financial markets are a reflection of supply and demand dynamics which lead to certain events, such as new market highs or lows, or turning points in short-term direction or long-term trend.

Available exclusively to Pro and Enterprise users, the Socrates Platform Timing Arrays are a proprietary cyclical analysis tool designed to study financial market events over time to help find when conditions for a future turning point or other cyclical event may be approaching.

Studying cyclical events in financial markets is often an overlooked aspect of technical analysis, but may offer valuable perspective when researching markets for potential turning points, and determining market entry and exit strategies.

The Timing Arrays compile dozens of computer models that independently and collectively monitor financial market price behavior for cyclical activity.

While only the most important models are displayed in the table, while the "Aggregate" summary at the tope serves as a composite view of the output from all the models behind the scenes.

The Timing Arrays are a premium tool available only to Socrates Pro and Enterprise users.

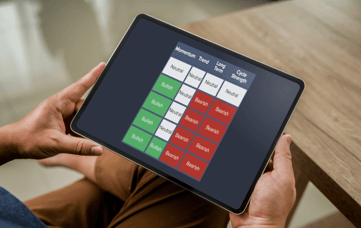

For easy reference, the Timing Arrays are presented in a single graphical table. Each row in the table is dedicated to one model in the collection, while each column represents a unit of time (a day, a week, a month, etc). The table updates after the close of each day, week, month, etc.

When multiple models in Timing Arrays table align (in particular, when an Aggregate peak, a Panic Cycle reading and a Direction Change reading align), this can be a signal of a potential turning point to further research.

Socrates Pro and Enterprise users can study the Reversal System to see if active bullish or bearish reversal points near current price offer resistance or support that may align with a Timing Array turning point.

The combination of Timing Arrays and the Reversal System offer Socrates Platform users a unique perspective when researching time and price sensitivity for potential turning points in global financial markets.

Importance of Monitoring Cycles

The Role of Historical Data in Cyclical Analysis

Studying financial market cycles requires a robust historical dataset and powerful models to systematically analyze the data. But no matter how sophisticated the models are, without ample historical data the insights derived from this computational analysis will be limited. Combining this rich data with powerful cyclical models of the Timing Arrays - along with the GMW and Reversal System - is what helps set the Socrates Platform apart from "other" research tools. Understanding the past is key to preparing for the future.

Timing Arrays offer a Dynamic Display of Cyclical Activity

A key proprietary model accessed exclusively through our premium market tools, the Timing Arrays is a consolidated view of output from various time-based computer models.

This array of output is displayed in a simple table of bar graphs. Each column represents a future unit of time (a day, week, month, etc). Each row is an individual model within the array. The top row is the "Aggregate" - a sum (or composite) of all models in the array, and easiest reference point to study.

This graphical format allows users to quickly see which models are aligning to pick up possible cyclical activity ahead.

As more data is fed into the models they build up a historical record of activity in order to continuously learn and refine its understanding. This iterative process allows the Timing Arrays to become "smarter" as each future unit of time approaches.

Most Socrates Pro users focus on Monthly Timing Arrays as it helps minimize the noise in day-to-day market movement, and is where cyclical events and turning points are more likely to reveal themselves. Socrates Enterprise users also have access to Quarterly and Yearly Timing Arrays.

The Role of Intelligent Software

By leveraging intelligent software - such as the proprietary models behind the Timing Arrays - users are empowered to research global financial market activity from various angles without having to be statisticians or financial professionals. The Socrates Platform does the complex data crunching on the backend to produce unique indicators that users can then easily incorporate into their research however and whenever they see fit.

Other Proprietary Models

View Our Membership Plans

The Socrates Platform is designed to give anyone direct access to information that was originally intended for industry professionals. This easy-to-use software-as-a-service solution allows you to research what you want, when you want. With different levels of engagement, the Socrates Platform has a version that works for just about anybody.